Fiscally Fit: Get your Assets in Shape: Barry’s Bootcamp Style. Powering Up Your Money Mojo. What’s good for your bottom is good for your bottom line too. Turns out the pursuit of physical fitness offers up some pretty fine clues into mastering your money issues. Healthy, Wealthy and Wise is a great way to go through life.

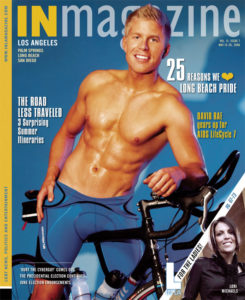

By David Rae Certified Financial Planner™, Accredited Investment Fiduciary™

Insights to get physically fit

Last week saw me waking up every day for the 5 a.m. class at Barry’s Bootcamp in West Hollywood. Before the sun had arisen, my husband, myself and a dedicated group of people who like to torture themselves pushed ourselves to the limit for one hour. Though the instructors are all built like Greek gods and the other people in the class aren’t too shabby either, by the time the last 10 minutes rolled around, I was suffering. To distract myself from the burning in my legs (and my arms and my glutes and my, oh hell, let’s just be honest declare my whole body in the Pain Zone), I kept thinking about how the insights we use in class to get physically fit could also help people get fiscally fit.

According to their website:

“Barry’s Bootcamp has been delivering The Best Workout in the World® to a legendary following, including A-list celebs, models—even Olympic athletes. Our signature hour-long workouts include 25-30 minutes of interval cardiovascular treadmill routines and 25-30 minutes of strength training utilizing free weights, resistance bands, medicine balls and other equipment. Trainers, muscle groups and even workout segments vary throughout the week so that no one class is ever the same.”

Appearances are deceiving.

Though we are all working our butts off in class, the room is mirrored so it’s easy to watch the other classmates. Ironically, some of the hottest guys-the ones that everyone assumes are in the best shape- have the most trouble keeping up, get winded first, and seem to take the most breaks. On the other hand, some of the ‘older’ members keep up the crazy pace of the class without a problem. The way they rock those treadmills, if we were on a track they’d be lapping me for sure.

Fiscal Fitness Takeaway: In the real world financial appearance can also be deceiving. Driving a nice car, wearing designer clothes and indulging in luxury vacations sure make life look exciting on your Instagram feed, but if they mean the bills are piling on credit card debt, you may look “rich” but you are mortgaging your future financial security.

Most of us do better with someone watching.

At Bootcamp, the superhot instructors give everyone attention and encouragement, walking back and forth to keep the class motivated. When I know they can see me or there’s another cute guy checking me out, I magically have more energy, can lift more weight and run a good deal faster. Plus, my own motivation increases when I see how hard other people in the class are working.

Fiscal Fitness Takeaway: Many people may improve their fiscal landscape by hiring a professional financial planner West Hollywood because it means someone else is watching over the funds. It’s harder to cheat on your retirement contributions knowing you’ll have to explain to your gay financial planner why you didn’t save enough this year. You may love the attention that a designer bag gets from your friends but may find it easier to skip some of those bigger purchases if you know the look your adviser will be giving you when he sees big charges adding to your credit card debt. (Full disclosure: Some of my clients confess they’re terrified when I give them ‘the look’. Moi?)

Breaking things up into manageable bites makes things easier.

At Bootcamp, we switch back and forth between lifting free weights on the floor and jumping onto the treadmill. Short goals and defined sets keep things moving and psychologically make getting through a class possible. And those 30-second treadmill sprints push me farther than just running for 15 or 30 minutes would ever do.

Fiscal Fitness Takeaway: Wrapping your head around saving for your kids’ college education, getting a down payment together for a new home, or planning for 30 years of retirement (or yikes! all three at once) is way too much to take in all at once for many people. Hence they ignore it to their peril. My advice is to break things into smaller, doable chunks. For example, saving $100,000 for a down payment is daunting. But saving $500 per paycheck is doable and easier to grasp and guess what? Keep it up and you’ll be meeting your goals before you know it.

The tools only work if you use them.

For those who own a treadmill and actually use it, the fitness payoffs are pretty great. For others who have a treadmill but don’t use it, well, they can count themselves proud owners of an expensive coat rack or an exposed junk drawer.

Fiscal Fitness Takeaway: Every single workout program in the universe (and there are thousands available in WeHo alone, I’m pretty sure) is merely a tool to help you reach your fitness goals. Likewise, retirement accounts, investments, and life insurance are just tools to help you reach your financial goals. Just as there is no one-size-fits-all best exercise routine, no single investment plan works for everyone. But actually using the right tools to meet your goals does work, whether you’re building killer abs or seek to achieve financial independence.

There are many more analogies between physical fitness and fiscal fitness. One thing I can guarantee is that if you stay on the couch watching TV you most likely won’t see amazing results either physically or fiscally. But getting started now and whipping your finances into shape can pay off big time in the future. The same way that whipping your body into shape will see you through to the end. The Nike folks have it right; Just Do It.

Fiscally Fit? You might also like “What Financial Health Means to Me.”

DAVID RAE, CFP®, AIF® is a Los Angeles-based wealth manager with DRM Wealth Management. He has been helping people reach their financial goals for over a decade. Follow him on Twitter @davidraecfp on Facebook or via his website, DavidRaeFP.com

[…] Fiscally Fit: The Barry’s Bootcamp Way […]

[…] you’ve hired a personal trainer, improved your diet, hit up Barry’s Boot Camp and still don’t look like a member of the U.S. Gymnastics Team. Are you stressed about money? Financial stress may be the cause of that pesky […]

[…] Fiscally Fit: Barry’s Bootcamp Way […]

[…] a healthy lifestyle won’t eliminate medical expenses but it can’t hurt. A gym membership and an annual physical is much less costly than a knee replacement and physical therapy. To get a […]

[…] row seat when it comes to seeing the difference between the effects of a healthy lifestyle and healthy money habits on people as they […]

[…] caught the bug that ‘more is more’, a soul-destroying treadmill at best. He learned the hard way that not only bigger isn’t necessarily better but better may […]

[…] can do all the sit-ups you want, but without a healthy diet you will never end up with a 6 pack. The same can be said for your finances: Without healthy spending habits, you will never achieve […]

[…] Staying healthy is a big focus of mine. As you heard above, I belong to a gym, and I also have a membership to a yoga studio. I am too cheap to pay by the class, and it is way too expensive to take yoga classes that way if you go regularly. The studio where I practice offers a nice discount if you pay in advance. For example, a monthly membership is $150, while an annual membership costs $900. That is a savings of 50% or $900. Now, I have $75 more per month that I can spend doing something else. […]

[…] Staying healthy is a big focus of mine. As you heard above, I belong to a gym, and I also have a membership to a yoga studio. I am too cheap to pay by the class, and it is way too expensive to take yoga classes that way if you go regularly. The studio where I practice offers a nice discount if you pay in advance. For example, a monthly membership is $150, while an annual membership costs $900. That is a savings of 50% or $900. Now, I have $75 more per month that I can spend doing something else. […]

[…] Staying healthy is a giant focus of mine. As you heard above, I belong to a fitness center, and I even have a membership to a yoga studio. I’m too low-cost to pay by the category, and it’s approach too costly to take yoga courses that approach if you happen to go usually. The studio the place I observe affords a pleasant low cost if you happen to pay prematurely. For instance, a month-to-month membership is $150, whereas an annual membership prices $900. That may be a financial savings of fifty% or $900. Now, I’ve $75 extra per thirty days that I can spend doing one thing else. […]

[…] is Nothing happy about being sick. Staying healthy and active can increase your retirement […]

[…] in pretty good shape physically, but I do more reps and work out harder when I have a knowledgeable training partner. Which in turn […]

[…] home in Palm Springs), I can tell you that there will always be someone richer, smarter, skinnier, buffer, or just more fabulous than you. Good for them. But now it’s time to step up and acknowledge […]